8 Easy Facts About Retirement Income Planning Explained

Table of ContentsThe Ultimate Guide To Retirement Income PlanningRumored Buzz on Retirement Income PlanningWhat Does Retirement Income Planning Do?Some Known Facts About Retirement Income Planning.Examine This Report on Retirement Income PlanningRetirement Income Planning - Truths

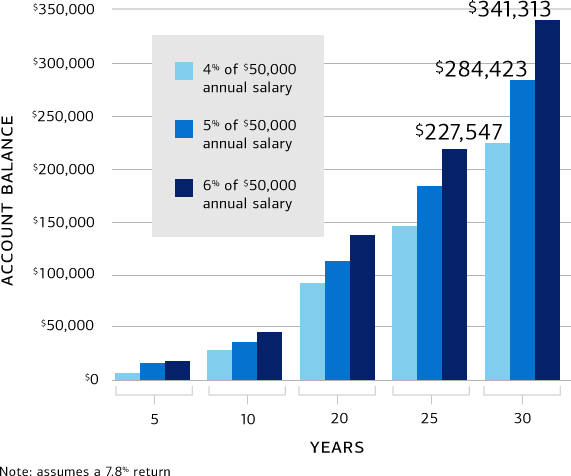

Retired life planning considers not only possessions as well as earnings but additionally future expenditures, liabilities, as well as life span. retirement income planning. If you are under 50, you can add a maximum of $22,500 in 2023 to a $401(k). In the most basic sense, retired life preparation is what one does to be planned for life after paid work ends.The non-financial facets consist of lifestyle choices such as exactly how to hang around in retired life, where to live, and also when to stop functioning entirely, to name a few points - retirement income planning. An alternative strategy to retired life planning takes into consideration all these areas. The emphasis that places on retirement planning modifications at different phases of life.

For instance: Individuals utilized to say that you need about $1 million to retire comfortably. Other professionals make use of the 80% rule, which specifies that you require sufficient to survive 80% of your earnings at retired life. If you made $100,000 per year, after that you would require cost savings that can create $80,000 per year for about 20 years, or an overall of $1.

The Greatest Guide To Retirement Income Planning

Others claim most retirees aren't saving anywhere near sufficient to fulfill those criteria as well as need to change their way of life to survive what they have. While the quantity of cash you'll intend to have in your savings is necessary, it's also an excellent idea to take into consideration every one of your expenditures.

And also because you'll have more spare time on your hands, you may also wish to element in the cost of enjoyment and traveling. While it may be difficult ahead up with concrete figures, make certain to find up with a sensible price quote so there are not a surprises later on.

No matter where you remain in life, there are numerous essential actions that put on nearly every person throughout their retired life preparation. The following are several of the most common: Develop a strategy. This consists of choosing when you intend to start saving, when you intend to retire, and also just how much you wish to conserve for your utmost goal.

How Retirement Income Planning can Save You Time, Stress, and Money.

Look at your financial investments from time to time as well as make regular changes. It's always a great suggestion to make any kind of changes whenever there's a change in your way of living and also when you go into a various phase in your life. Pension can be found in lots of sizes and shapes. The guidelines as well as regulations for every might be various.

You can and ought to add greater than the quantity that will certainly gain the company match. Some experts recommend upwards of 10%. For the 2023 tax obligation year, individuals under look here age 50 can contribute as much as $22,500 of their earnings to a 401(k) or 403(b), some of which may be additionally matched by an employer.

The typical specific retired life account (INDIVIDUAL RETIREMENT ACCOUNT) lets you place aside pre-tax dollars. This suggests that the cash you save is subtracted from your revenue prior to your tax obligations are secured. It lowers your taxable income as well as, as a result, your tax obligation. So if you get on the cusp of a greater tax brace, purchasing a standard individual retirement account can knock you down to a reduced one.

Our Retirement Income Planning Statements

:max_bytes(150000):strip_icc()/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png)

Individuals who are 50 as well as older can spend an extra $1,000 for an overall of $7,500 in 2023. Distributions should be taken at age 72 and also can be taken as early as 59.

A Roth individual retirement account can be a superb tool for young grownups, funded with post-tax bucks. This eliminates the immediate tax obligation reduction but prevents a more substantial revenue tax obligation bite when the money is withdrawn at retired life. Beginning a Roth Individual retirement account early can pay off huge time in the long run, also if you do not have a great deal of cash to invest at.

Some Known Incorrect Statements About Retirement Income Planning

Roth IRAs have some constraints. The contribution restriction for either individual retirement account (Roth or typical) is $6,500 a year, or $7,500 if you more than age 50. Still, a Roth has some earnings limitations: A solitary filer can add the total just if they make $129,000 or much less annually, Read Full Article since the 2022 tax obligation year, as well as $138,000 in 2023.

Catch-up contributions of $3,500 allow staff members 50 or older to bump that limitation up to $19,000. Once you set up a retired life account, the inquiry ends up being just how to route the funds.

Getting The Retirement Income Planning To Work

Below are some guidelines for successful retired life preparation at various stages of your life. Those embarking on grown-up life might not have a whole lot of money totally free to invest, however they do have time to allow financial investments mature, which review is a vital as well as beneficial piece of retired life savings. This is because of the concept of compounding.